Day Note for Nov 29, 2018

29th November

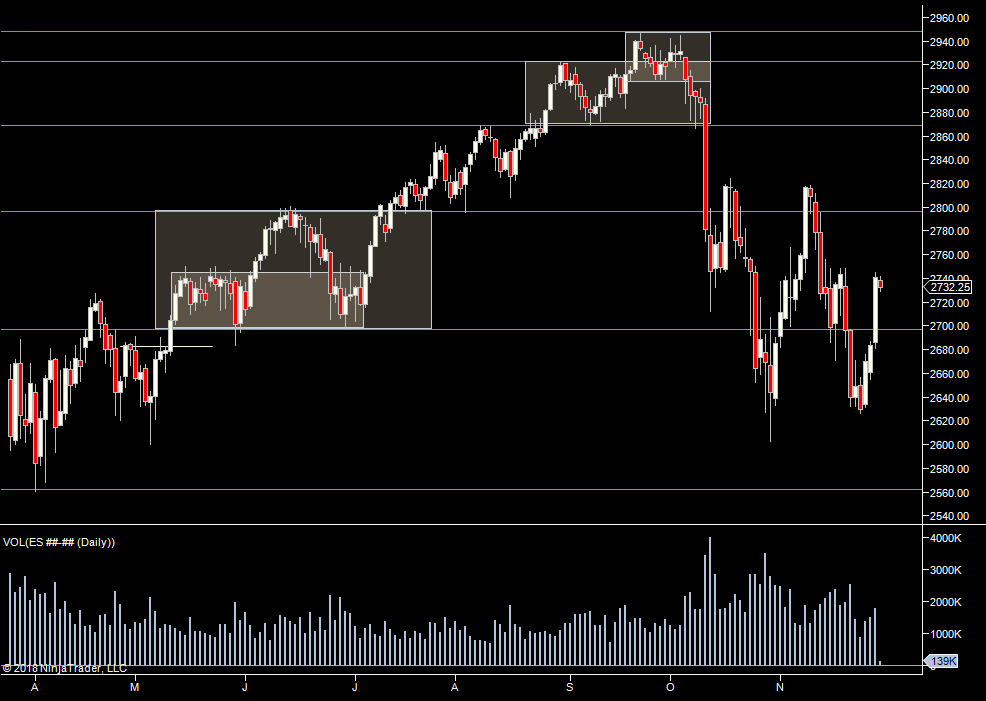

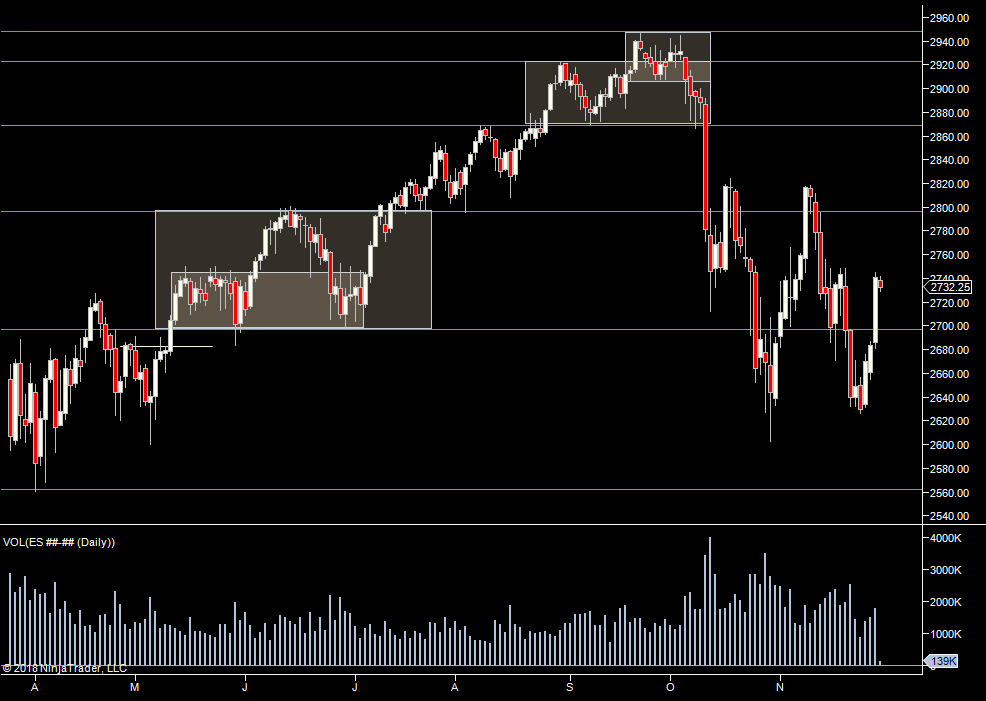

An interesting day yesterday. Powell speaking did move the market but it still remains a reasonably 'technical' market.

By that I mean - it really looks like day traders are playing the common trades on ES and being the dominant force. In terms of yesterday we said "Last week, we can see a huge drop from 2730 to 2700. So 2700 is worth keeping an eye on today. If it breaks upside, we could be at 2730 very quickly." - and that's what happened. Yesterdays overnight low was just above prior days value. Todays overnight has held the prior days value/high. It's not a guarantee but this seems to be somewhat back to normal players at the table.

To the left, we can see that 2750 held before the last push down. That's where we are close to now, so any move away with volume will probably be jumped on.

The weekly profiles show that break at 2700 - there's still not much traded between 2700 and 2720, so eyes on that.

Daily high is holding overnight so eyes on that.

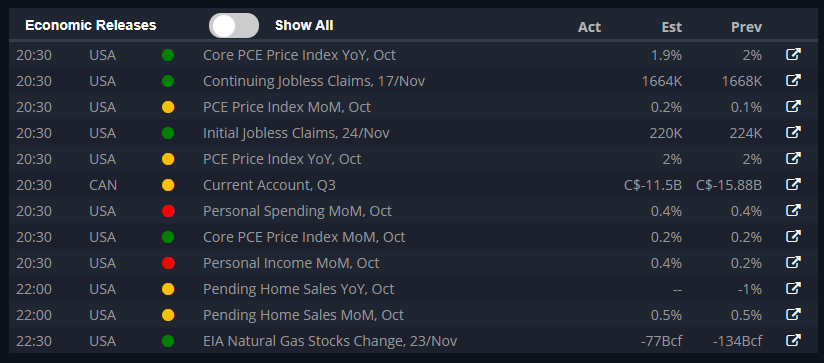

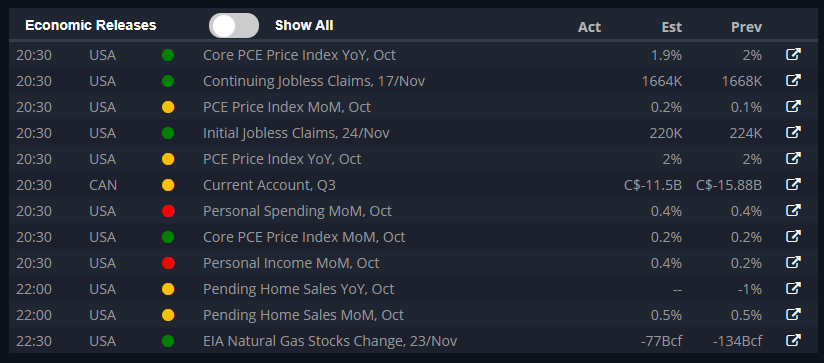

FOMC today - but still expecting some volatility in the AM.

Plan

- early trade on (note yesterday, there was no step near the open)

- watching day trader levels for a reaction

- eyes on 2750 - prior rejection - jump on strong moves away in either direction

Weekly Numbers

Range - 2631.50 -> 2692.50

Value - too elongated

Daily Numbers

Range - 2681 / 2684.25 -> 2745

Value -too elongated

Globex - 2728.75 -> 2742.25

Settlement- 2741.50

Today only - 2725 (expecting a drop to 2700 below), 2750 (prior rejection)

Long Term Levels - 2797.50, 2868.75, 2892.75, 2922.50, 2697

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

29th November

An interesting day yesterday. Powell speaking did move the market but it still remains a reasonably 'technical' market.

By that I mean - it really looks like day traders are playing the common trades on ES and being the dominant force. In terms of yesterday we said "Last week, we can see a huge drop from 2730 to 2700. So 2700 is worth keeping an eye on today. If it breaks upside, we could be at 2730 very quickly." - and that's what happened. Yesterdays overnight low was just above prior days value. Todays overnight has held the prior days value/high. It's not a guarantee but this seems to be somewhat back to normal players at the table.

To the left, we can see that 2750 held before the last push down. That's where we are close to now, so any move away with volume will probably be jumped on.

The weekly profiles show that break at 2700 - there's still not much traded between 2700 and 2720, so eyes on that.

Daily high is holding overnight so eyes on that.

FOMC today - but still expecting some volatility in the AM.

Plan

- early trade on (note yesterday, there was no step near the open)

- watching day trader levels for a reaction

- eyes on 2750 - prior rejection - jump on strong moves away in either direction

Weekly Numbers

Range - 2631.50 -> 2692.50

Value - too elongated

Daily Numbers

Range - 2681 / 2684.25 -> 2745

Value -too elongated

Globex - 2728.75 -> 2742.25

Settlement- 2741.50

Today only - 2725 (expecting a drop to 2700 below), 2750 (prior rejection)

Long Term Levels - 2797.50, 2868.75, 2892.75, 2922.50, 2697