Day Note for Dec 07, 2018

7th December

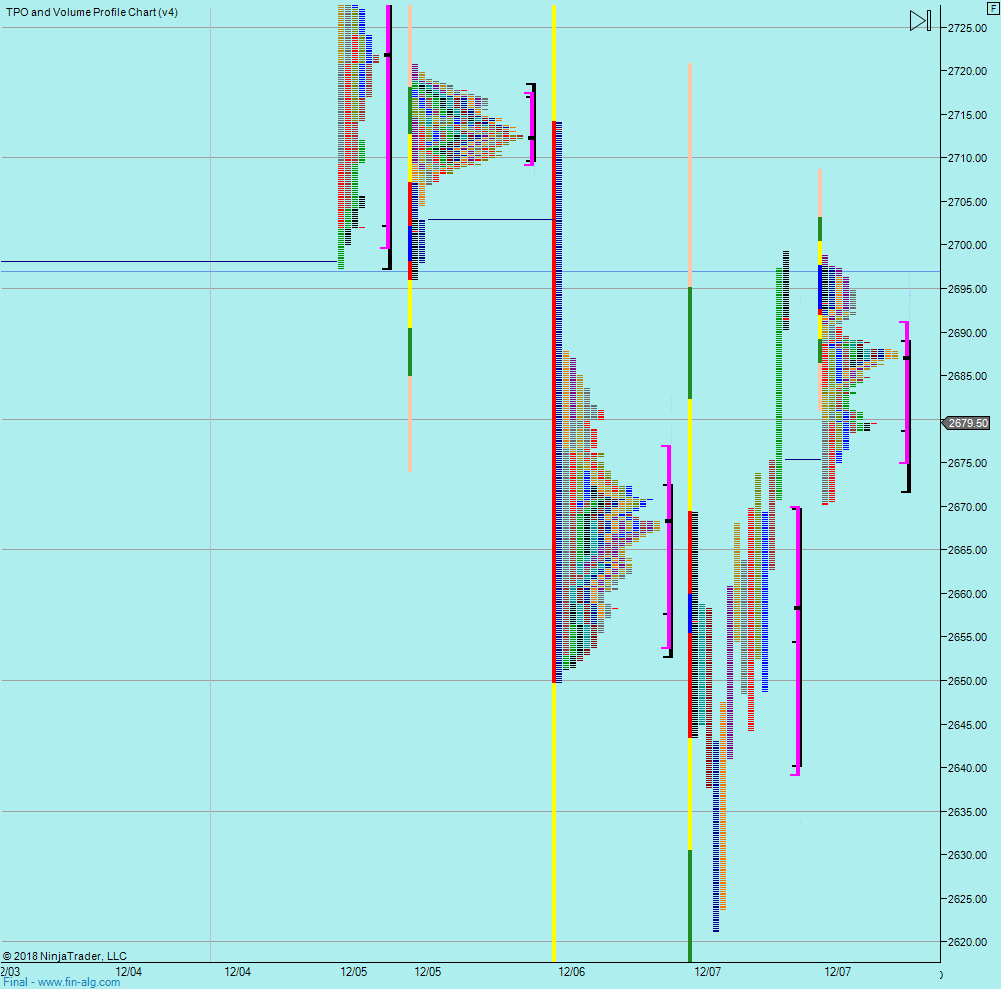

Yesterday we were looking for the range low around 26 or 03. As you can see above it was around the most recent push down. So a push through and rebound up.

Overnight another push down. Looking left we are in a big range. So my expectation after testing the low is we traverse to the highs - but we should consider the current position to be just like the middle of any range - choppy. So it might take a few attempts to get on the right side of any move.

OR - look at an instrument with some liquidity...

Not much to deduce from the weekly profile - 200 points range almost. It's just really, really volatile.

Interestingly - the overnight session bottomed out around yesterdays value high and topped out around yesterdays day session high. It doesn't seem like it would be a technical market but with the hold of the range low, I guess we'd better keep an eye on the levels today.

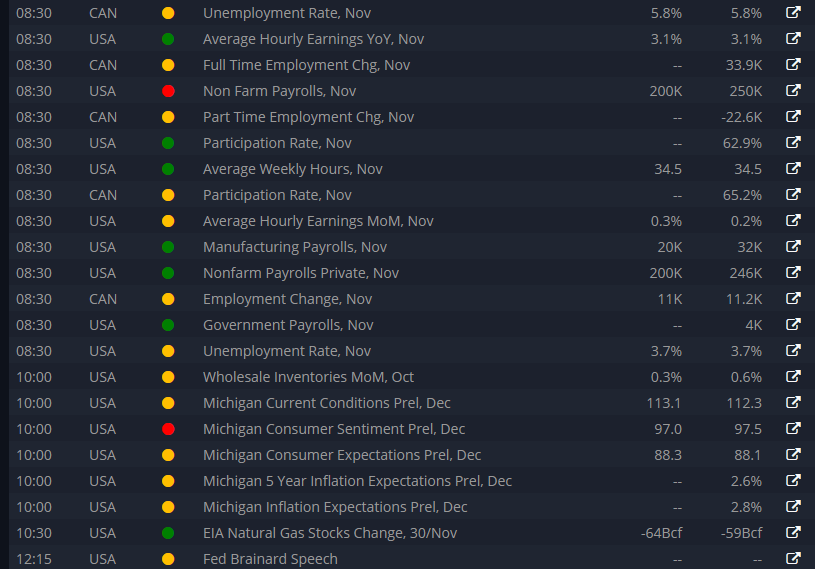

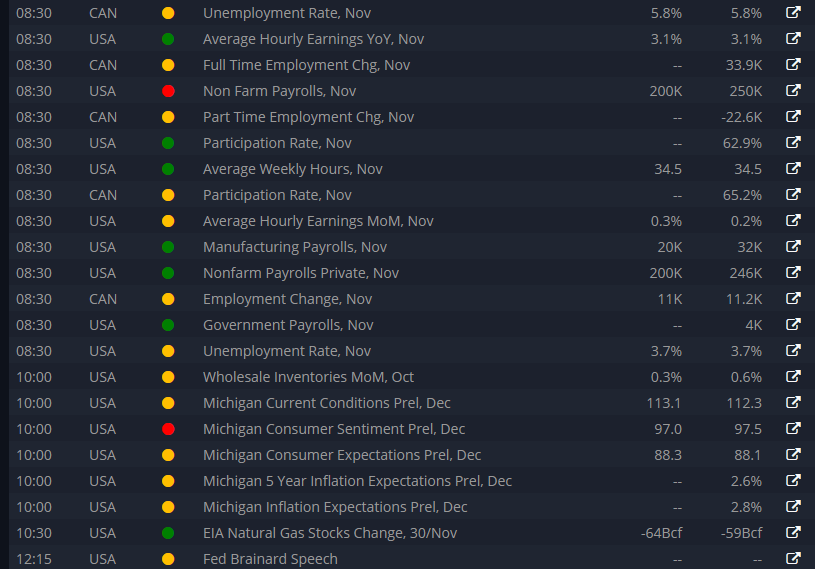

Plenty of news again. Order of the day is assess the volatility - yesterday it was sweeping 6 or 7 levels at a time and that's a tough environment to trade in as it requires a lot more risk.

Plan

- Open Trade on

- Long bias - be nice to see a downside level tested for a long - which would need market moving down another 9 points from here. Alternative would be a break of yesterdays high. Between the 2 - I don't see a great reason for getting in.

- of course if yesterdays high holds, then shorts are on - so treating it like a typical day trader day but more 'slidey' and looking to enter into momentum AFTER a level.

Weekly levels - too elongated IMO

Daily Numbers

Range - 2621.25 -> 2699.25

Value - 2639.25 -> 2699.75

Globex - 2670.25 -> 2798.75

Settlement - 2691

Today only - 2603->2626

Long Term Levels - 2797.50, 2868.75, 2892.75, 2922.50, 2697

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

7th December

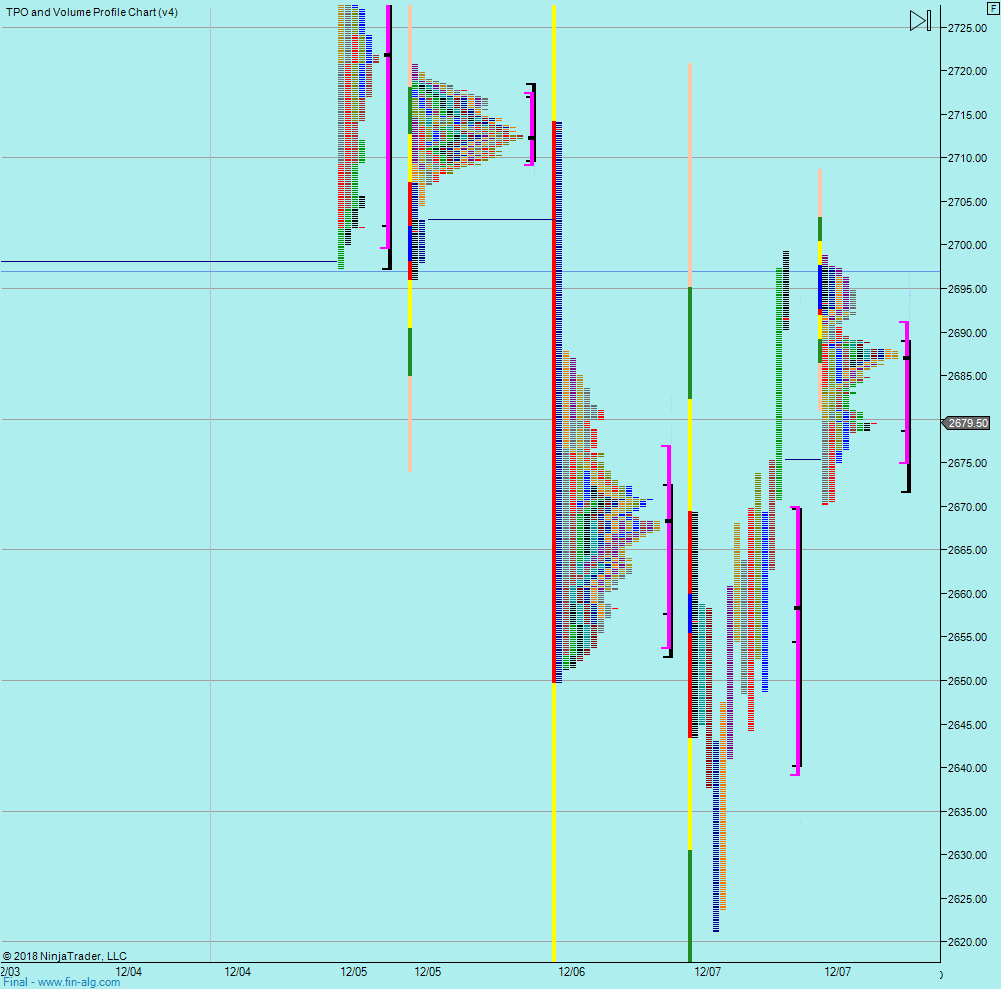

Yesterday we were looking for the range low around 26 or 03. As you can see above it was around the most recent push down. So a push through and rebound up.

Overnight another push down. Looking left we are in a big range. So my expectation after testing the low is we traverse to the highs - but we should consider the current position to be just like the middle of any range - choppy. So it might take a few attempts to get on the right side of any move.

OR - look at an instrument with some liquidity...

Not much to deduce from the weekly profile - 200 points range almost. It's just really, really volatile.

Interestingly - the overnight session bottomed out around yesterdays value high and topped out around yesterdays day session high. It doesn't seem like it would be a technical market but with the hold of the range low, I guess we'd better keep an eye on the levels today.

Plenty of news again. Order of the day is assess the volatility - yesterday it was sweeping 6 or 7 levels at a time and that's a tough environment to trade in as it requires a lot more risk.

Plan

- Open Trade on

- Long bias - be nice to see a downside level tested for a long - which would need market moving down another 9 points from here. Alternative would be a break of yesterdays high. Between the 2 - I don't see a great reason for getting in.

- of course if yesterdays high holds, then shorts are on - so treating it like a typical day trader day but more 'slidey' and looking to enter into momentum AFTER a level.

Weekly levels - too elongated IMO

Daily Numbers

Range - 2621.25 -> 2699.25

Value - 2639.25 -> 2699.75

Globex - 2670.25 -> 2798.75

Settlement - 2691

Today only - 2603->2626

Long Term Levels - 2797.50, 2868.75, 2892.75, 2922.50, 2697