Day Note for Dec 17, 2018

17th Dec

Looking at the calendar, we should be good for trading volume till Friday. Christmas eve is on Monday, so it appears to have fallen nicely from a trading perspective. Still -eyes on volume. Over to the March contract too.

I am hoping that maybe we'll see a more liquid March contract but I'm not holding my breath... We still have the same news events hanging over our heads and Mrs May has decided to leave us with Brexit uncertainty until January.

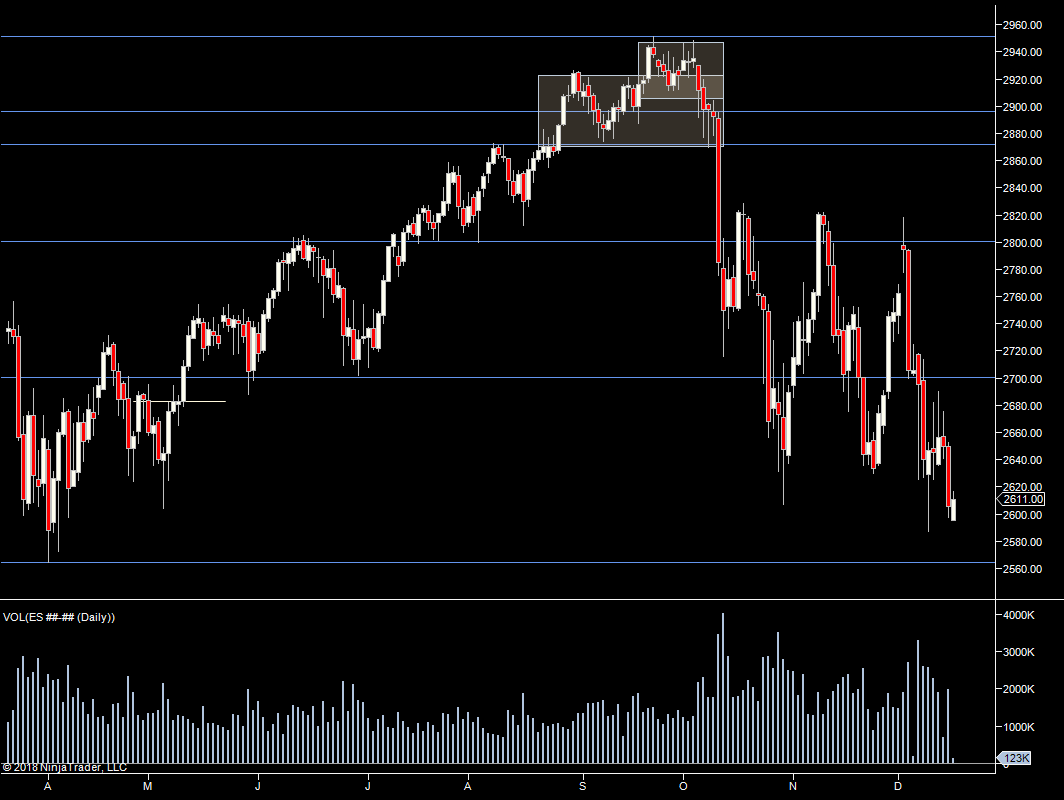

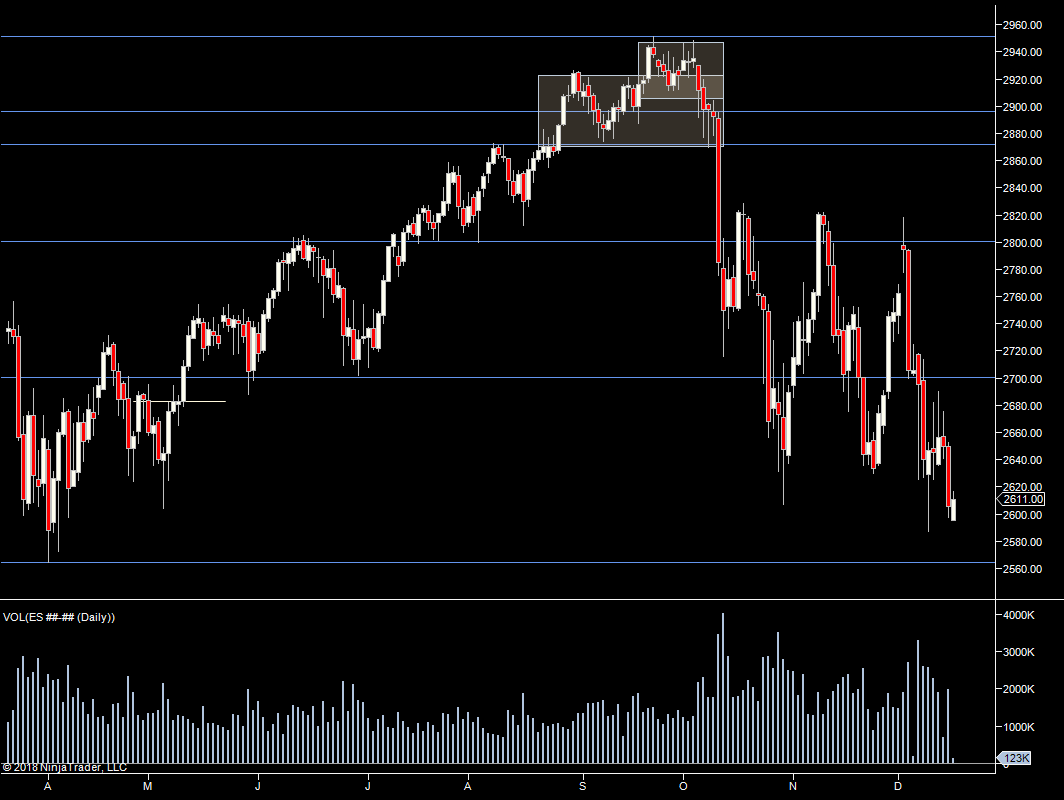

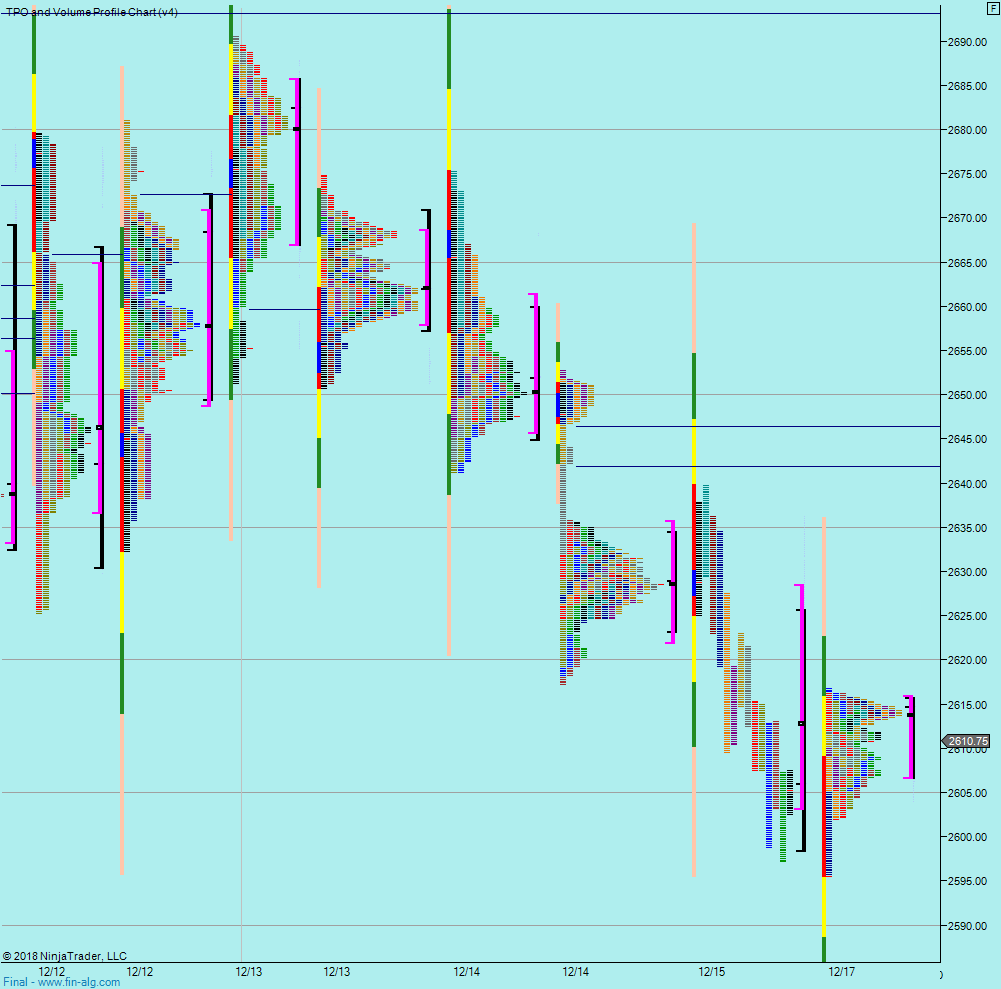

Anyway - we are at the bottom of the range still with an eye on last weeks low and 2564.75 below.

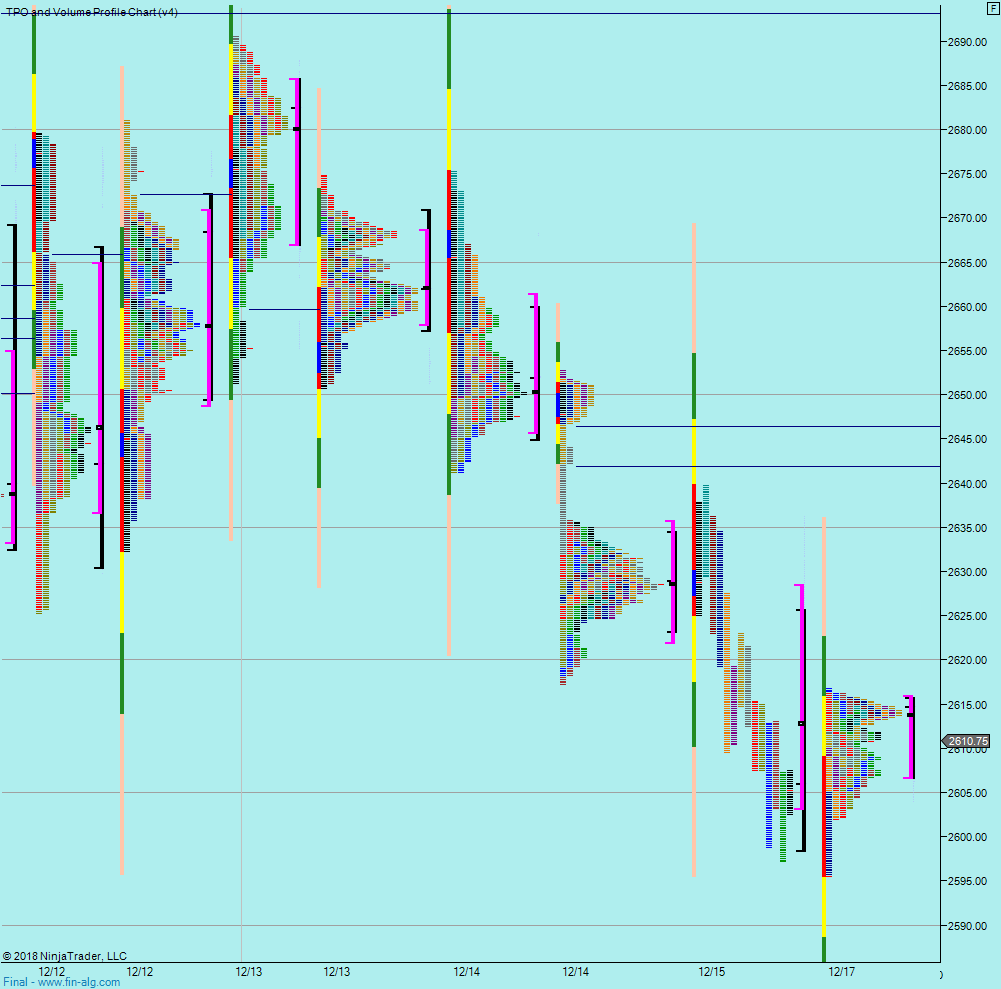

No weekly profile today - because of the roll. We can see that overnight, Fridays range has been tested and held, all but a little push through.

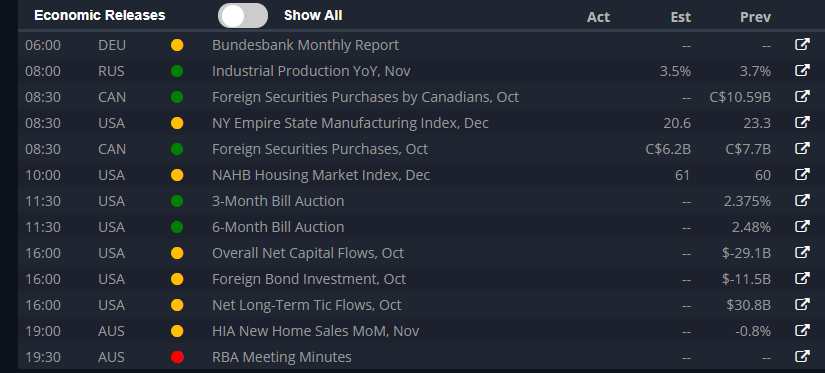

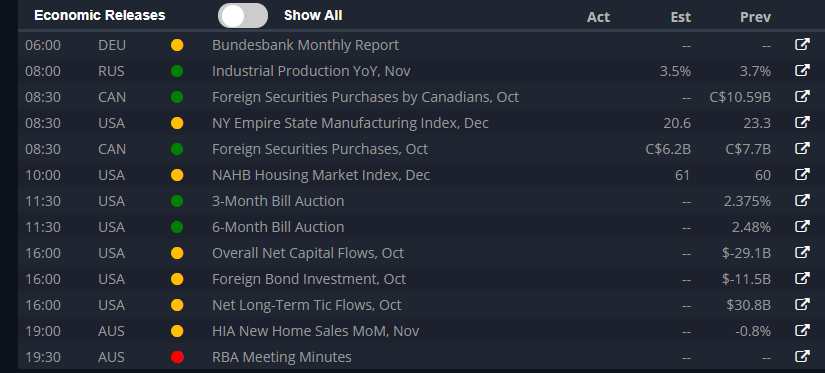

Not much in the news today.

Plan

- Early trade on if we open near a volume step from overnight

- Shorts below Fridays low but long anywhere above that

- Expecting volatility, so waiting for volume to set the direction and then for a price to lean on

- Expecting all hell to break loose if we break 2564

- Still not at all in love with these market conditions. If I liked this, I'd be trading DAX

Weekly levels

Not interested because of the range

Daily Numbers

Range - 2597.25 -> 2639.75 / 2652.75

Value - 2595.50 -> 2628.25

Globex - 2610.25 -> 2616.75

Settlement - 2602

Today only - 2603->2626

Long Term Levels - 2564.75, 2700.25, 2800.75, 2872, 2896. 2925.75, 2951.25

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

17th Dec

Looking at the calendar, we should be good for trading volume till Friday. Christmas eve is on Monday, so it appears to have fallen nicely from a trading perspective. Still -eyes on volume. Over to the March contract too.

I am hoping that maybe we'll see a more liquid March contract but I'm not holding my breath... We still have the same news events hanging over our heads and Mrs May has decided to leave us with Brexit uncertainty until January.

Anyway - we are at the bottom of the range still with an eye on last weeks low and 2564.75 below.

No weekly profile today - because of the roll. We can see that overnight, Fridays range has been tested and held, all but a little push through.

Not much in the news today.

Plan

- Early trade on if we open near a volume step from overnight

- Shorts below Fridays low but long anywhere above that

- Expecting volatility, so waiting for volume to set the direction and then for a price to lean on

- Expecting all hell to break loose if we break 2564

- Still not at all in love with these market conditions. If I liked this, I'd be trading DAX

Weekly levels

Not interested because of the range

Daily Numbers

Range - 2597.25 -> 2639.75 / 2652.75

Value - 2595.50 -> 2628.25

Globex - 2610.25 -> 2616.75

Settlement - 2602

Today only - 2603->2626

Long Term Levels - 2564.75, 2700.25, 2800.75, 2872, 2896. 2925.75, 2951.25