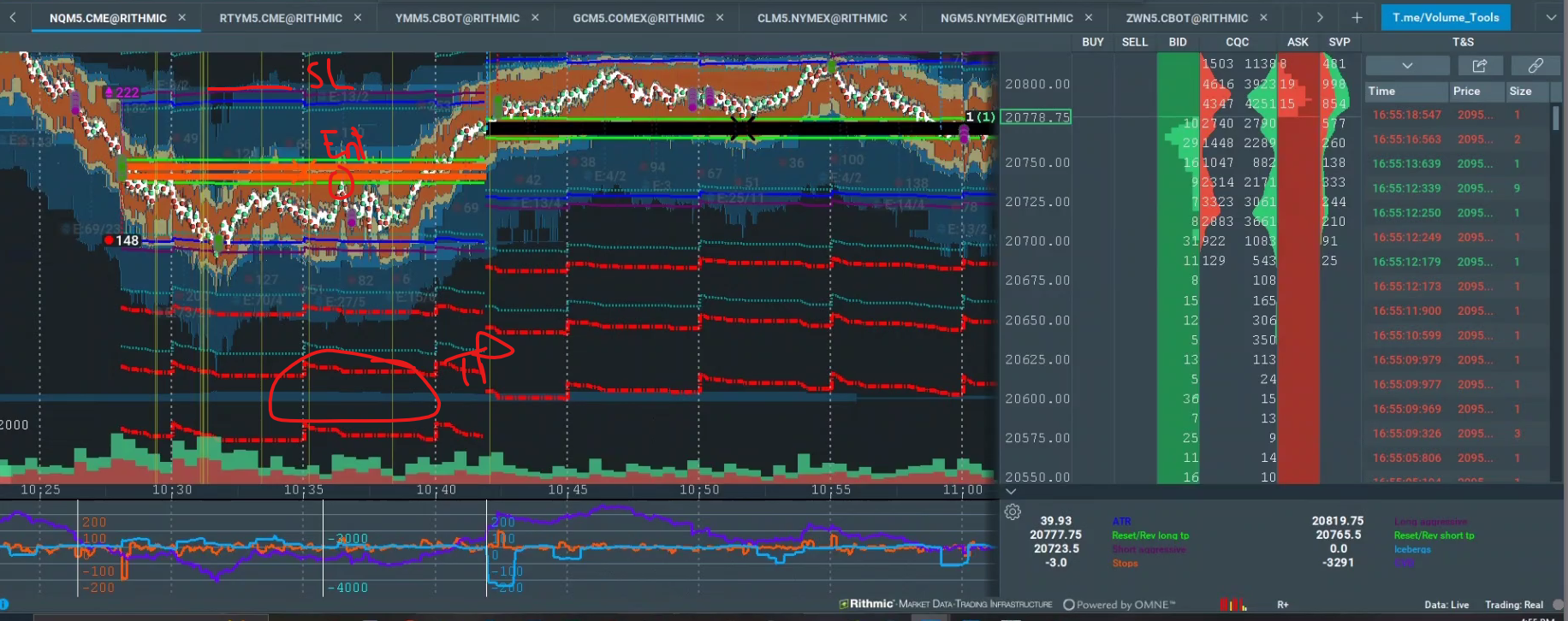

SL = 213 tick, $434, RR = 2.3

Reason: Algo Guy Bearish, SI Stop Event Confirmed Bearish. Band of liquidity at 20600.

Context: Price failed above a composite VAH and fell inside. Was looking for move to POC which was also around that band of liquidity. Price reacted off of an inflection level and ultimately reversed. Price made a huge gap up so wasn't expecting a neutral day, but that's what it turned out to be.

Entry: as per strategy, limit order right under zone

Exit: Hit Stop Loss.

Mistakes: Went Short right as price reached an inflection level. Inflection level was a previously large wick. Typically you would want to fade those levels not enter a trade trying to break it.

Emotions Before: Really want to trade. Had a good weekend of going over stats and really wanted to get in there. Also first trade after increasing size.

Emotions During: Abit confused but accepting of a potential loss. I thought the setup was good.

Emotions After: Fairly accepting of loss

Did Well: Turned down setups in NG and ZS as they wernt exactly per rules and entered this because it met the strategy rules.

Needs Improvement: Consider more where we are. If we are at an inflection zone or other potential support before entering.

Would I Take Again: Yes, the setup was good.

#outbalance #neutral #weaktrend #gameon #goodentry #priceheld #hitstop #wrongontrade #highvol #avgretest #notupset #ineedtotradenow #imgood

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

| Fill Time | Type | Qty | Price |

|---|

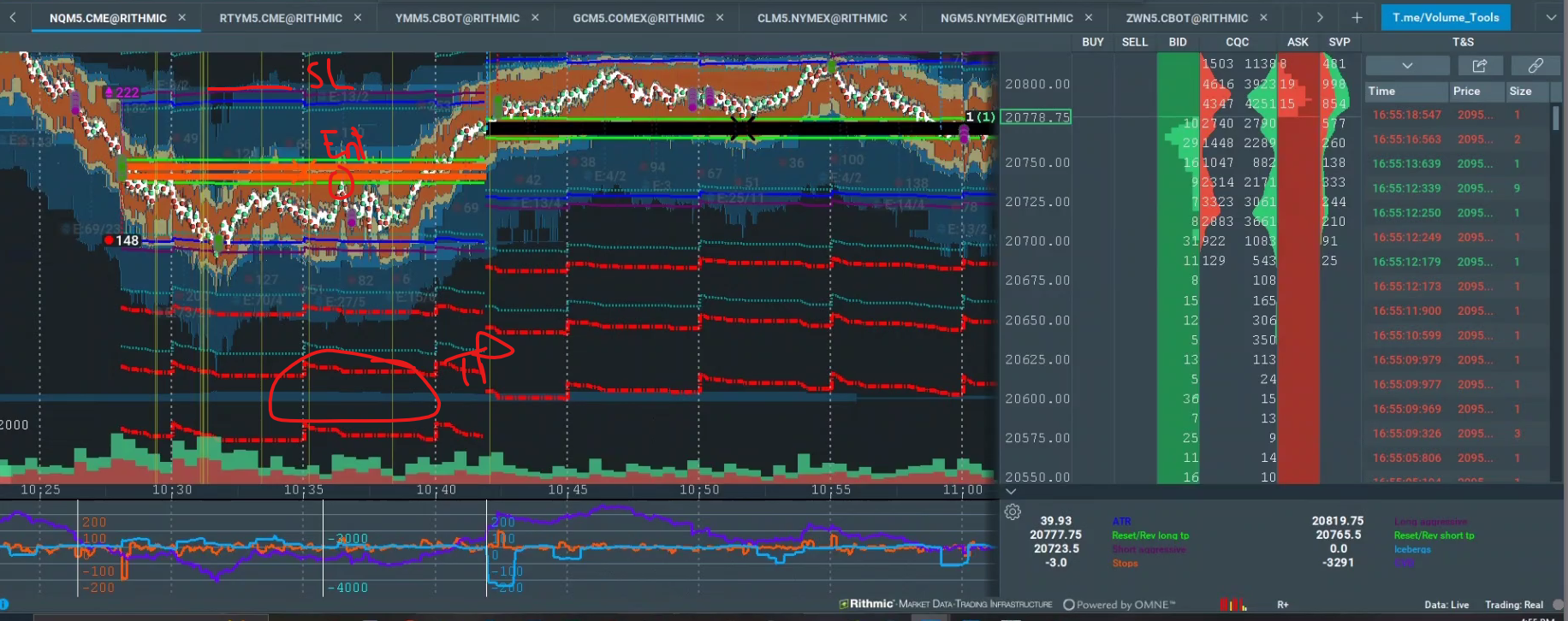

SL = 213 tick, $434, RR = 2.3

Reason: Algo Guy Bearish, SI Stop Event Confirmed Bearish. Band of liquidity at 20600.

Context: Price failed above a composite VAH and fell inside. Was looking for move to POC which was also around that band of liquidity. Price reacted off of an inflection level and ultimately reversed. Price made a huge gap up so wasn't expecting a neutral day, but that's what it turned out to be.

Entry: as per strategy, limit order right under zone

Exit: Hit Stop Loss.

Mistakes: Went Short right as price reached an inflection level. Inflection level was a previously large wick. Typically you would want to fade those levels not enter a trade trying to break it.

Emotions Before: Really want to trade. Had a good weekend of going over stats and really wanted to get in there. Also first trade after increasing size.

Emotions During: Abit confused but accepting of a potential loss. I thought the setup was good.

Emotions After: Fairly accepting of loss

Did Well: Turned down setups in NG and ZS as they wernt exactly per rules and entered this because it met the strategy rules.

Needs Improvement: Consider more where we are. If we are at an inflection zone or other potential support before entering.

Would I Take Again: Yes, the setup was good.

#outbalance #neutral #weaktrend #gameon #goodentry #priceheld #hitstop #wrongontrade #highvol #avgretest #notupset #ineedtotradenow #imgood