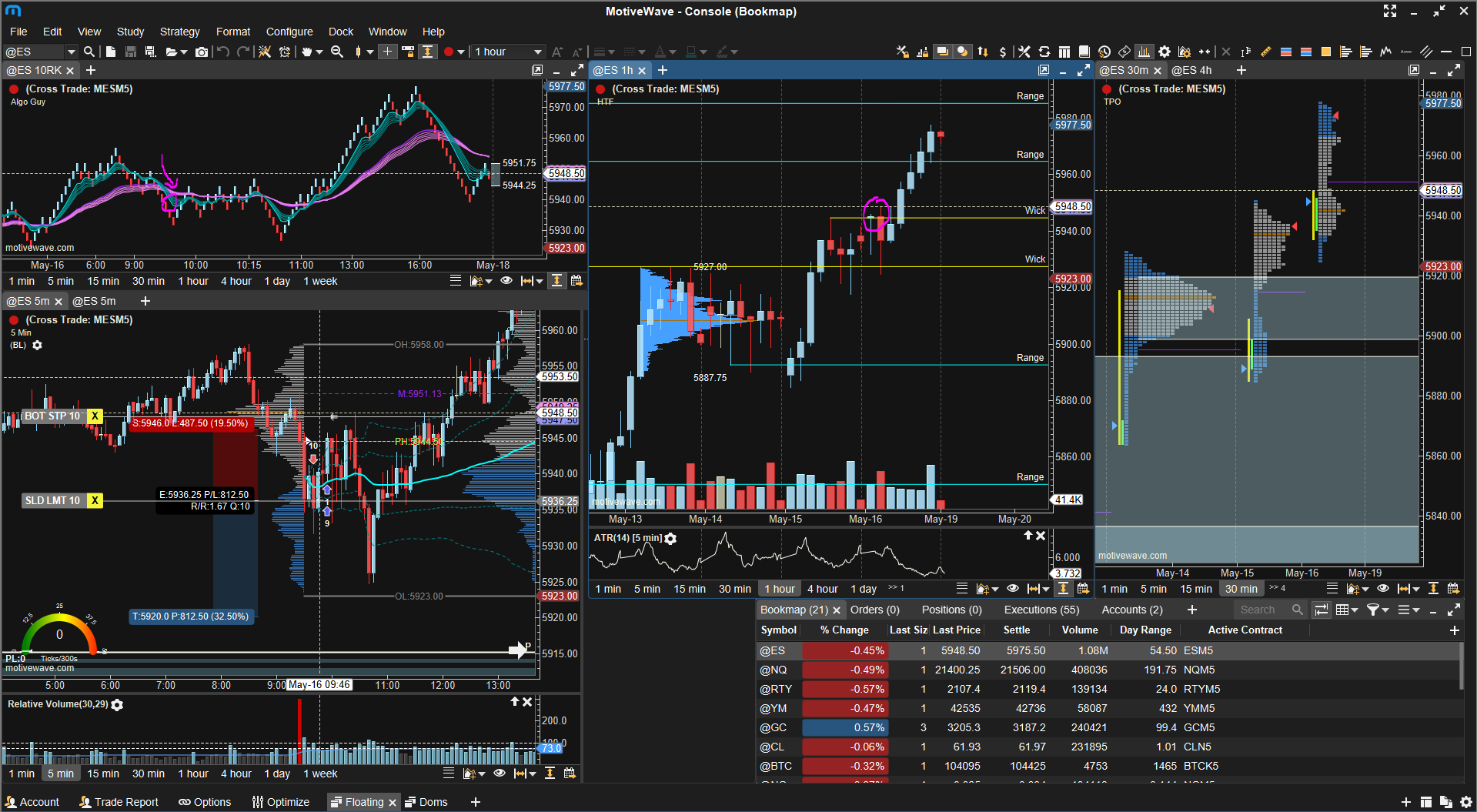

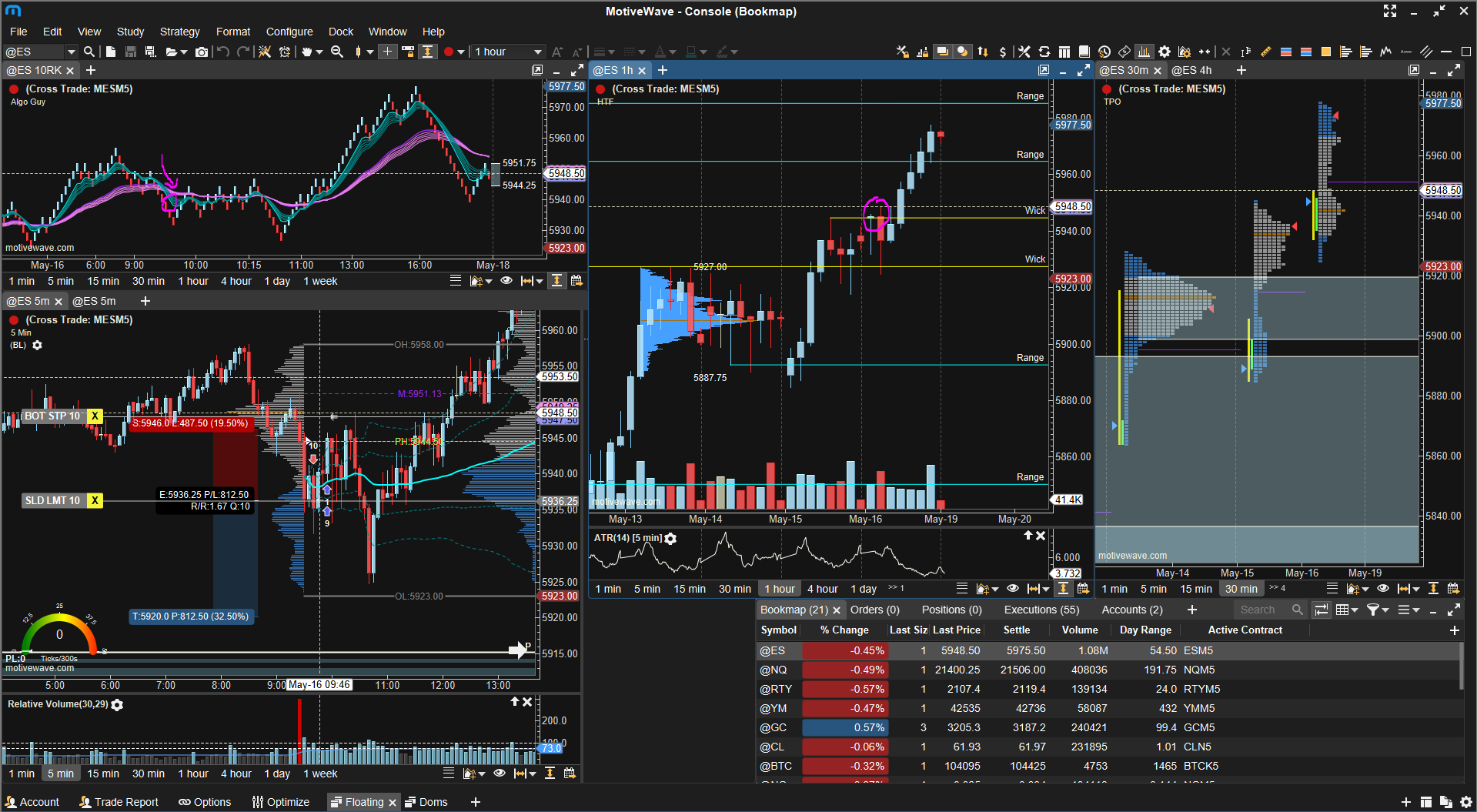

SL: 39 tick = $487.5, RR = 1.36

Reason: Algo Guy had just turned bearish. Wasnt an established trend yet. Si Iceberg event off the open bearish, Liquidity below.

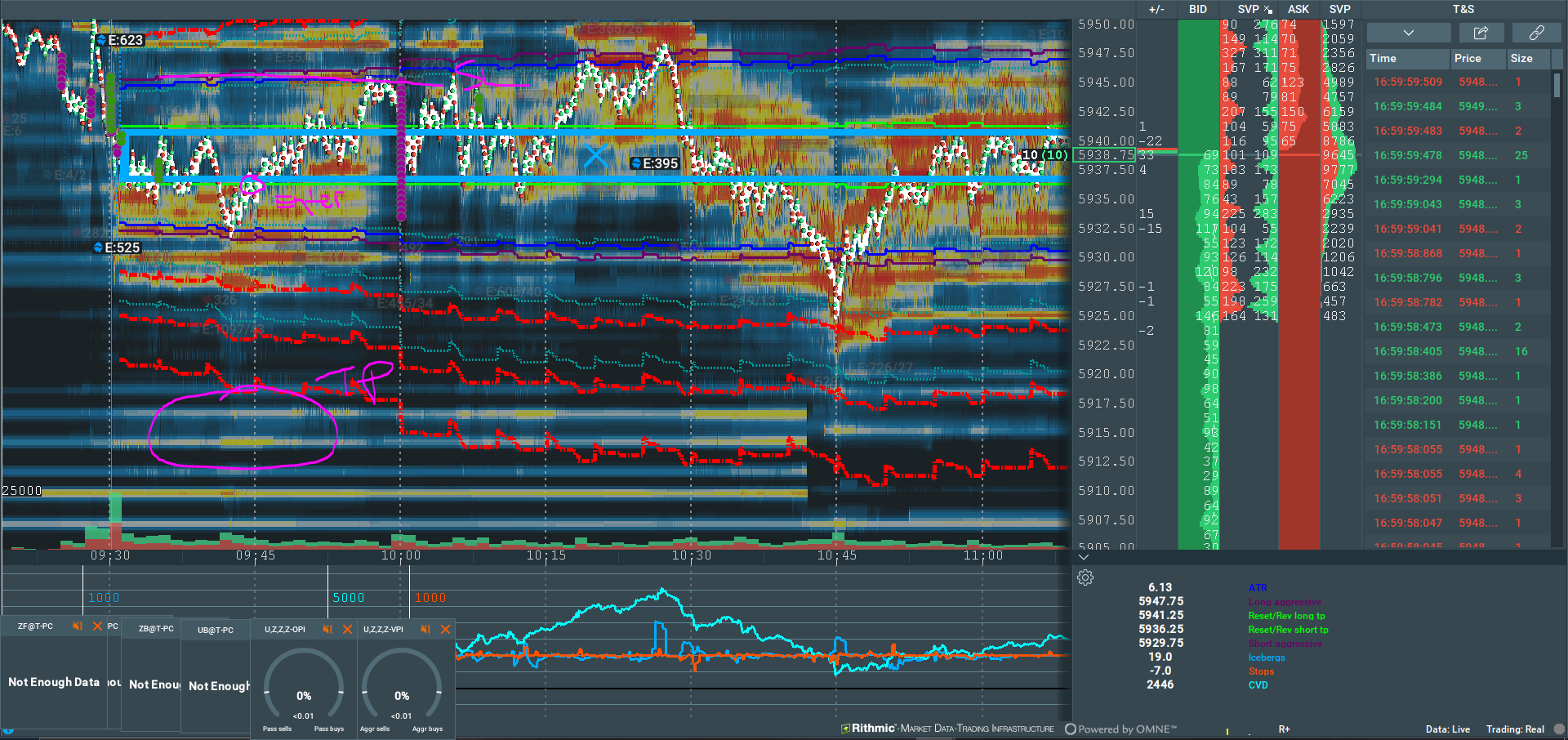

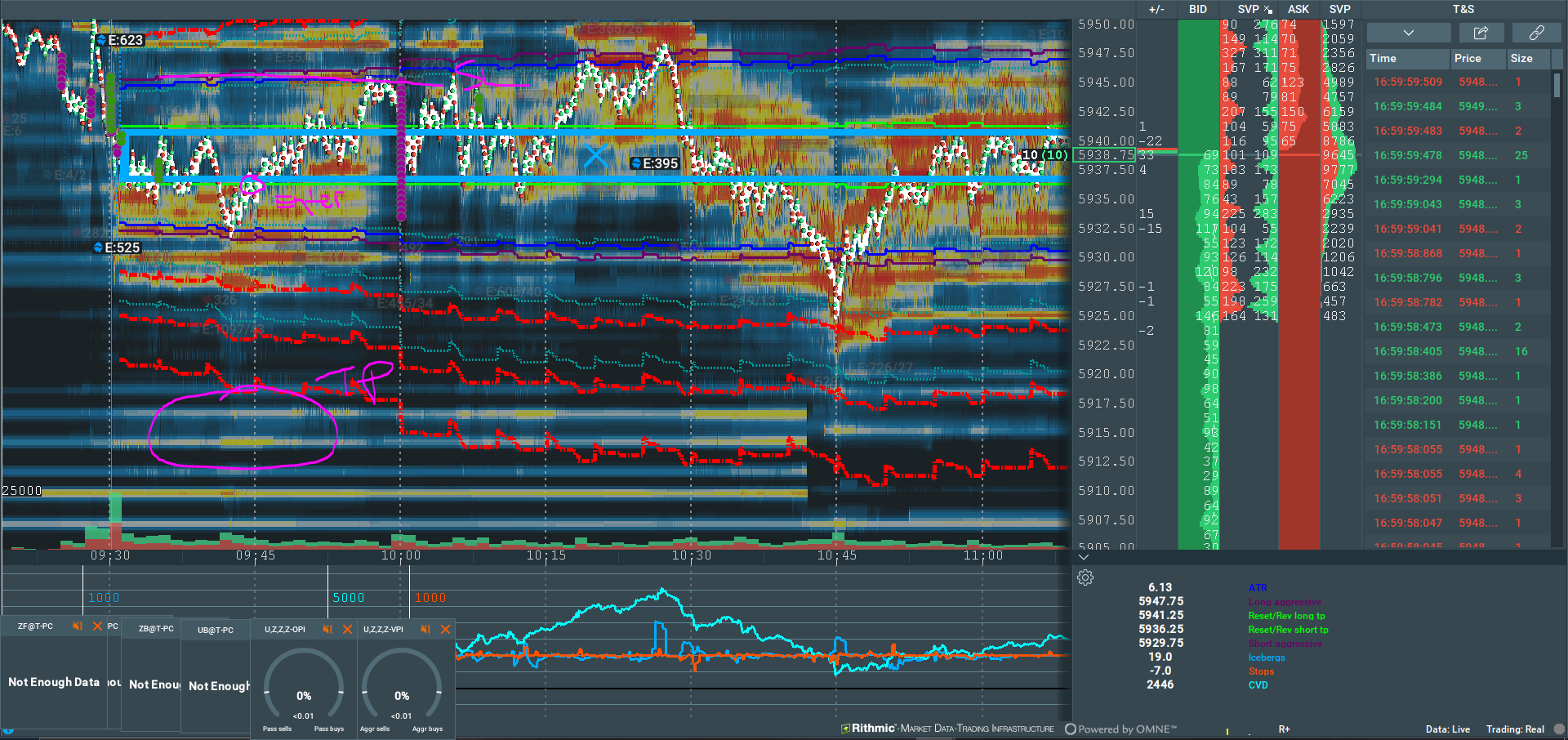

Context: Price had just wicked the previous day RTH high. was looking for it to retrace the range. Few problems upon review. The Si event was made at the open, I have no proof of this but perhaps they arnt as reliable as thats just generally when a rush of orders enter. The -1 Std Dev band was just touched. wasnt a great confirmation. and lastly there were a tonnnnn of orders beneath me. looking at the heatmap you can see there are way more limit bids right below my zone than above. Order book was defiantly skewed to the upside.

Entry: Limit order right below zone, limit was filled and traded through instatly

Exit: Stop Loss hit, Was slipped 2 full points! due to taking the trade on the micro contract. lost an extra 100 from slippage.

Mistakes: I think there were quite a few red flags on this one that needed to be paid attention too. Still within the rules but combined led to a poor trade. 1. The Si event barley confirmed bearish. The 1 atr band was kissed then rejected, usually a bad sign. 2. The large amount of liquidity below my entry, can see all the orange right below my blue box. 3. Traded 10 contracts but still took it on the micro contract. Could have traded 1 mini and had more liquidity. 4. The SI event was created right at the open, From now on im going to ignor events at the open, I have heard to wait 10-15 minutes after open. 5. Algo guy was barley bearish, the long term line was flat, only the short term was sloping down.

Emotions Before: Good, really wanted to trade, took no trades yesterday due to a poor sleep so really wanted to make up for it. Didnt want to miss an opportunity.

Emotions During: Trade went instantly against me, Was at peace with a stop out tho.

Emotions After: Super annoyed at the slippage. Need another trade asap

Did Well: Handled the stop out well and held it to the end.

Needs Improvement: If there's lots of red flags, skip. Next trade is just around the corner. There was a nice CL opportunity that I missed and a ZS trade that I caught.

Would I take again: No, lots of red flags, if i wasnt looking for a trade so bad would have skipped it I think.

#inbalance #notrend #suckyouin #goodentry #tradedthrough #hitstop #wrongontrade #highvol #avgretest #notupset #ineedtotradenow #imgood

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

| Fill Time | Type | Qty | Price |

|---|

SL: 39 tick = $487.5, RR = 1.36

Reason: Algo Guy had just turned bearish. Wasnt an established trend yet. Si Iceberg event off the open bearish, Liquidity below.

Context: Price had just wicked the previous day RTH high. was looking for it to retrace the range. Few problems upon review. The Si event was made at the open, I have no proof of this but perhaps they arnt as reliable as thats just generally when a rush of orders enter. The -1 Std Dev band was just touched. wasnt a great confirmation. and lastly there were a tonnnnn of orders beneath me. looking at the heatmap you can see there are way more limit bids right below my zone than above. Order book was defiantly skewed to the upside.

Entry: Limit order right below zone, limit was filled and traded through instatly

Exit: Stop Loss hit, Was slipped 2 full points! due to taking the trade on the micro contract. lost an extra 100 from slippage.

Mistakes: I think there were quite a few red flags on this one that needed to be paid attention too. Still within the rules but combined led to a poor trade. 1. The Si event barley confirmed bearish. The 1 atr band was kissed then rejected, usually a bad sign. 2. The large amount of liquidity below my entry, can see all the orange right below my blue box. 3. Traded 10 contracts but still took it on the micro contract. Could have traded 1 mini and had more liquidity. 4. The SI event was created right at the open, From now on im going to ignor events at the open, I have heard to wait 10-15 minutes after open. 5. Algo guy was barley bearish, the long term line was flat, only the short term was sloping down.

Emotions Before: Good, really wanted to trade, took no trades yesterday due to a poor sleep so really wanted to make up for it. Didnt want to miss an opportunity.

Emotions During: Trade went instantly against me, Was at peace with a stop out tho.

Emotions After: Super annoyed at the slippage. Need another trade asap

Did Well: Handled the stop out well and held it to the end.

Needs Improvement: If there's lots of red flags, skip. Next trade is just around the corner. There was a nice CL opportunity that I missed and a ZS trade that I caught.

Would I take again: No, lots of red flags, if i wasnt looking for a trade so bad would have skipped it I think.

#inbalance #notrend #suckyouin #goodentry #tradedthrough #hitstop #wrongontrade #highvol #avgretest #notupset #ineedtotradenow #imgood