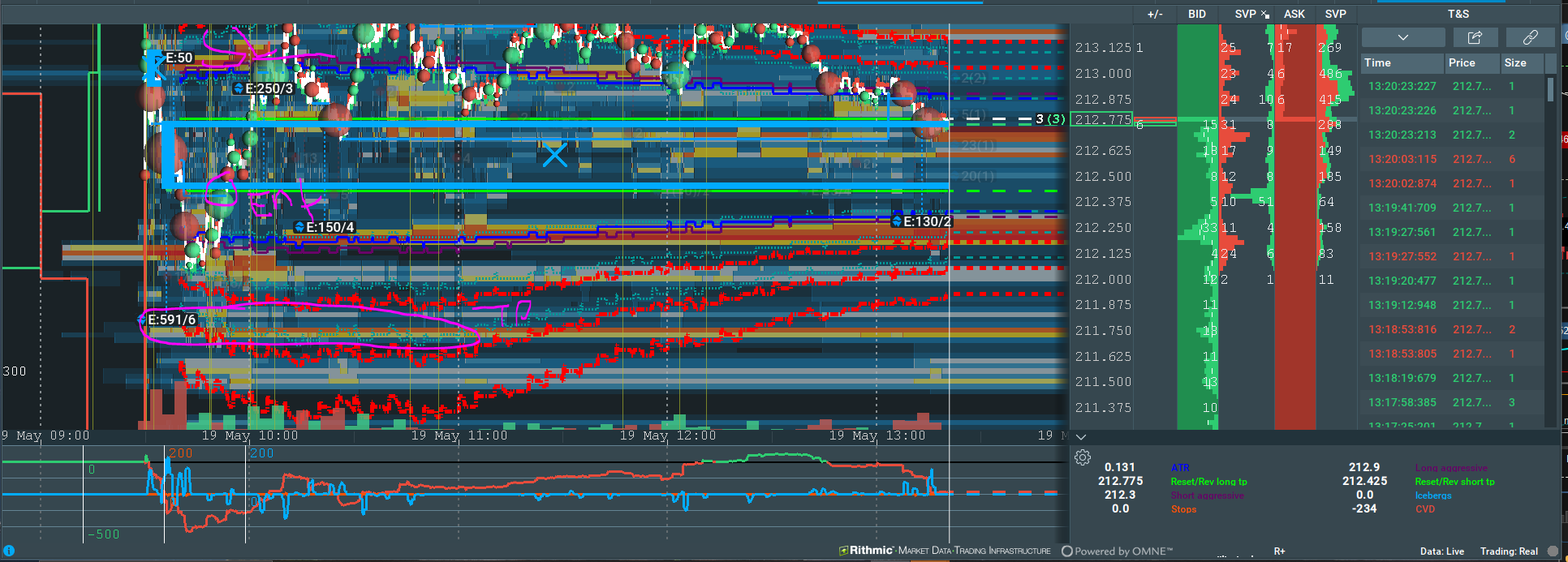

SL: $460, RR: 1.13

Reason: Algo guy just turned bearish, Large SI Ice event off the open, Liquidity below as well as overnight value area step for TP

Context: Thought this one actually had a really good context which is why i took it even tho algo guy wasnt in an established down trend. The long ema band of algo guy was still pretty bullish actually. Price swept an equal high from yesterday and fell pretty hard. Usually this leads to a break lower, price can typically test the poc of the range or the high of the range again before falling, the stop was placed high enough to allow for this. This was more a mean reversion trade, the tpo at the time was within balance inside a composite value area from the previous two days. I was looking for a move to the low of the composite value area. So i had composite value area on my side as well as price action.

Entry: limit order as per

Exit: Hit stop loss

Mistakes: Thought it was pretty good setup, only issue would be algo guy was pretty neutral and the SI event was made at the market open.

Emotions Before: Actually pretty happy, first trade in Cattle

Emotions During: Fairly accepting, Position sizing was spot on, First stop out in Cattle

Emotions After: Really thought that was a good setup so not that annoyed.

Did Well: Felt like I had a good thesis of context, even tho it didnt work out.

Needs Improvement: Be more selective of neutral algo guy trades. These trades do work but from what iv seen have less probability, my pure momentum, algo guy pointed down, trades tend to work the best. Also im starting to see a pattern that Events created right at market open might not mean much.

Would I take again: Yes, still think the setup was good.

#inbalance #normal #notrend #slowmethodical #goodentry #tradedthrough #hitstop #wrongontrade #highvol #avgretest #notupset #slighturgetotrade #imgood

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

| Fill Time | Type | Qty | Price |

|---|

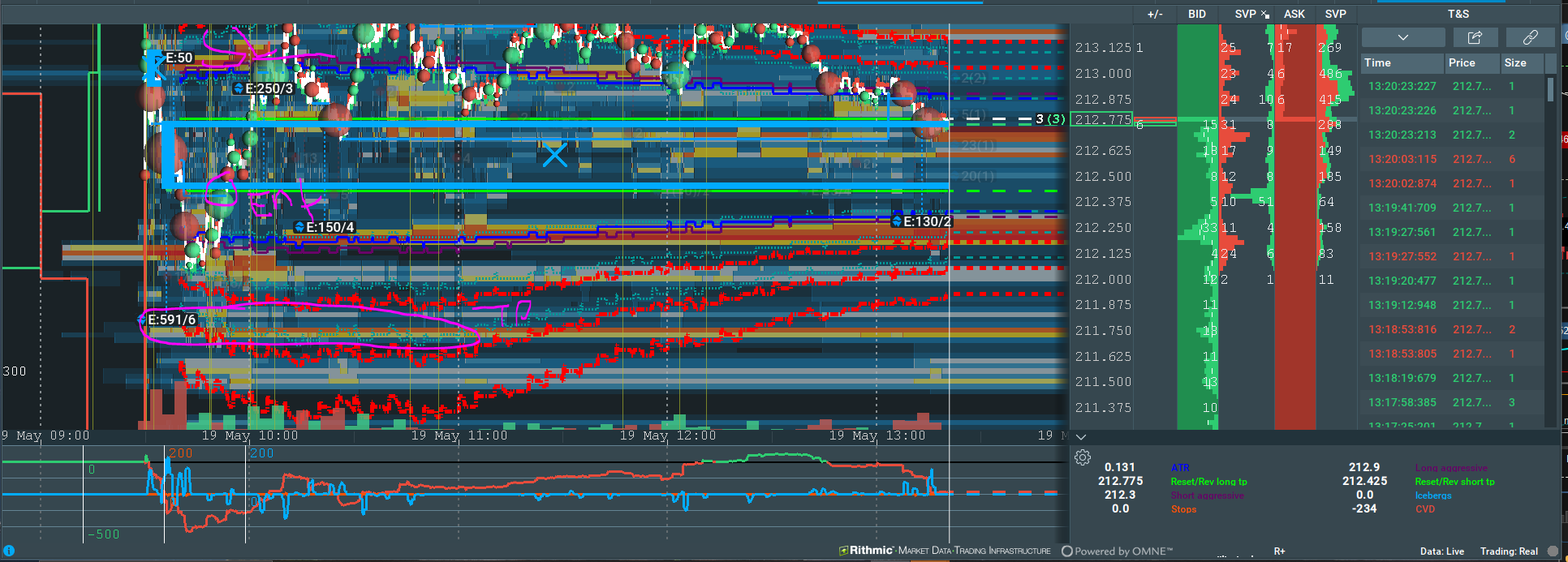

SL: $460, RR: 1.13

Reason: Algo guy just turned bearish, Large SI Ice event off the open, Liquidity below as well as overnight value area step for TP

Context: Thought this one actually had a really good context which is why i took it even tho algo guy wasnt in an established down trend. The long ema band of algo guy was still pretty bullish actually. Price swept an equal high from yesterday and fell pretty hard. Usually this leads to a break lower, price can typically test the poc of the range or the high of the range again before falling, the stop was placed high enough to allow for this. This was more a mean reversion trade, the tpo at the time was within balance inside a composite value area from the previous two days. I was looking for a move to the low of the composite value area. So i had composite value area on my side as well as price action.

Entry: limit order as per

Exit: Hit stop loss

Mistakes: Thought it was pretty good setup, only issue would be algo guy was pretty neutral and the SI event was made at the market open.

Emotions Before: Actually pretty happy, first trade in Cattle

Emotions During: Fairly accepting, Position sizing was spot on, First stop out in Cattle

Emotions After: Really thought that was a good setup so not that annoyed.

Did Well: Felt like I had a good thesis of context, even tho it didnt work out.

Needs Improvement: Be more selective of neutral algo guy trades. These trades do work but from what iv seen have less probability, my pure momentum, algo guy pointed down, trades tend to work the best. Also im starting to see a pattern that Events created right at market open might not mean much.

Would I take again: Yes, still think the setup was good.

#inbalance #normal #notrend #slowmethodical #goodentry #tradedthrough #hitstop #wrongontrade #highvol #avgretest #notupset #slighturgetotrade #imgood