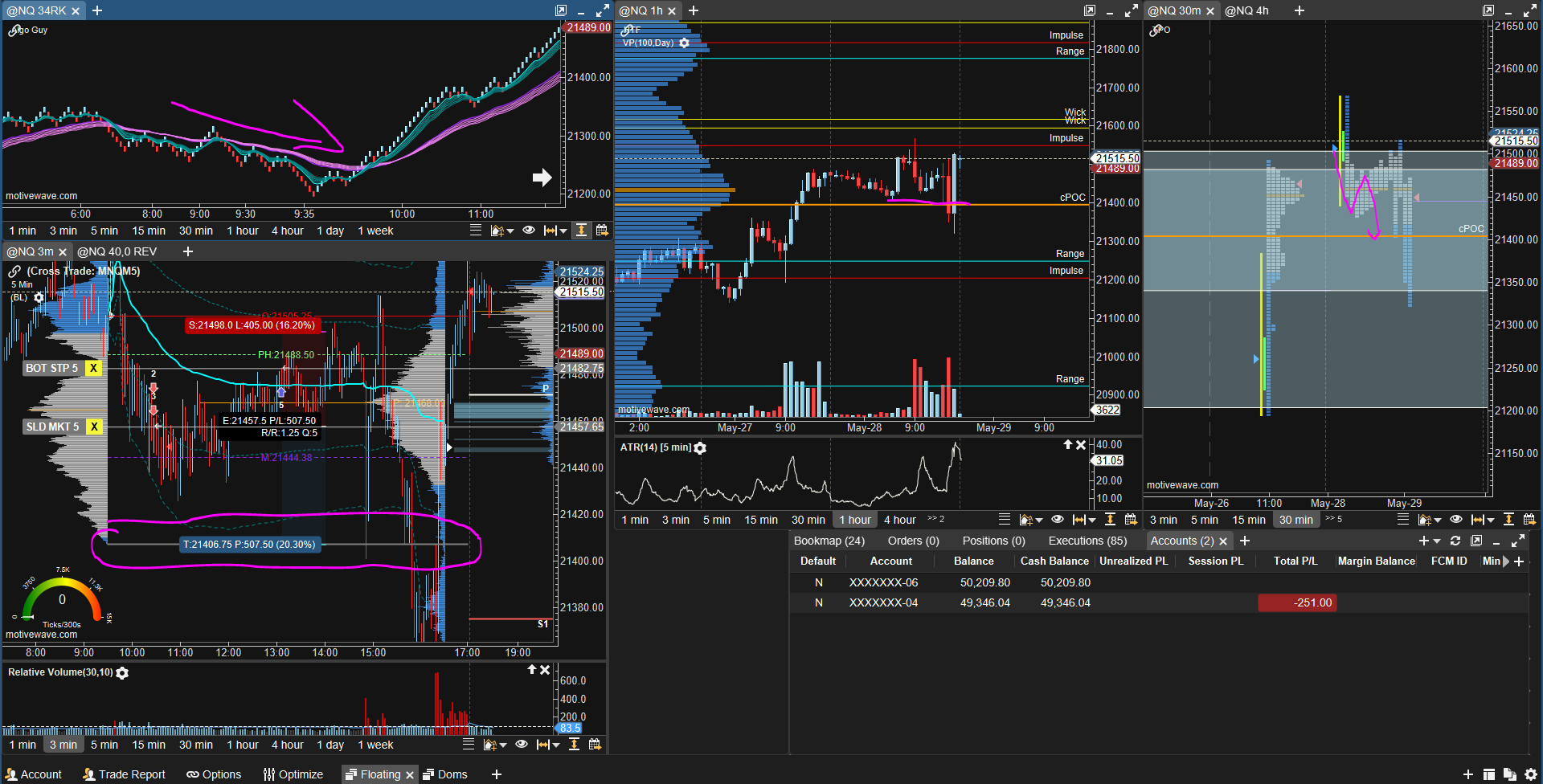

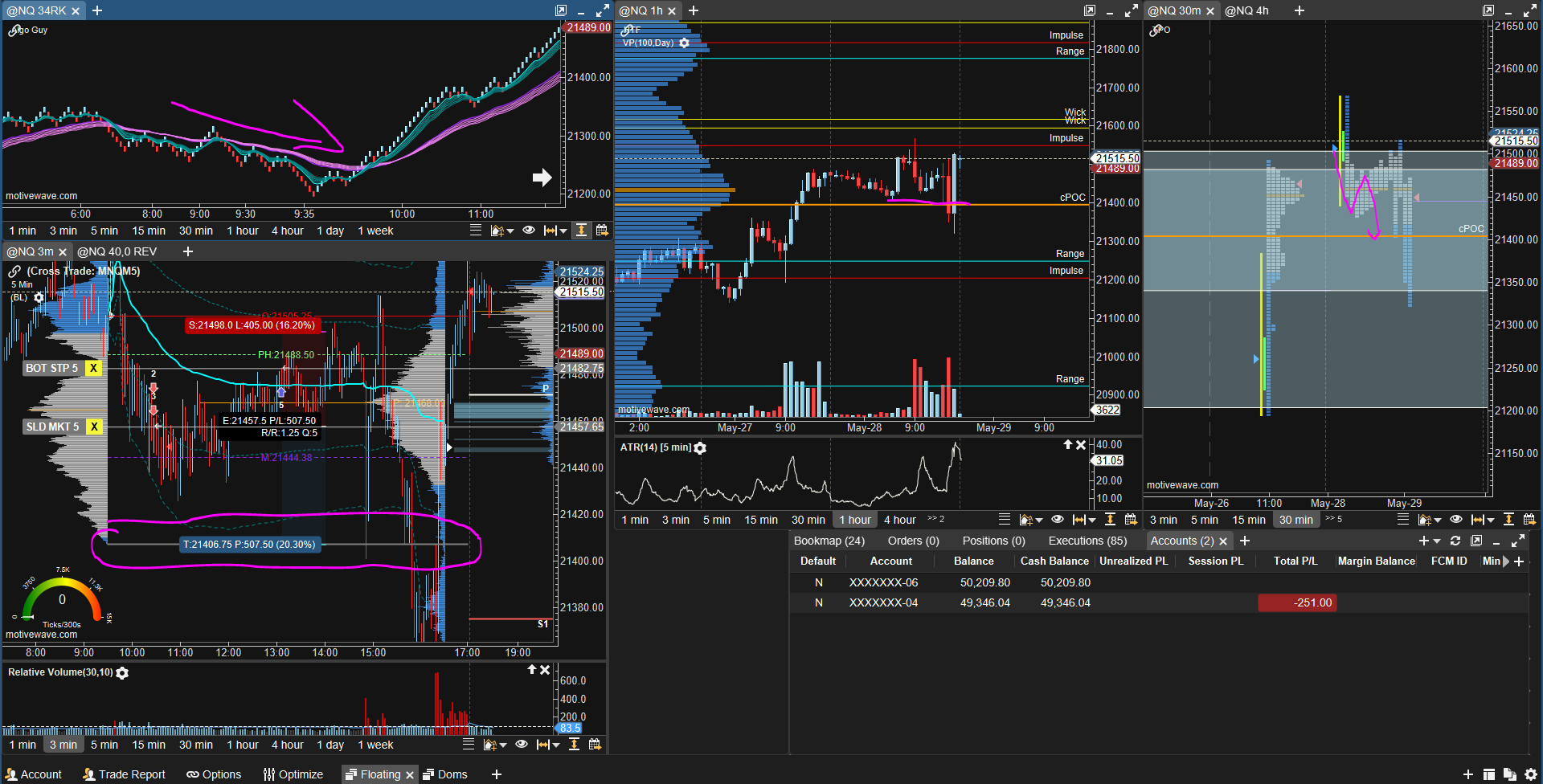

SL: $405 RR: 1.25

Reason: Algo Guy Bearish, Solid down trend in price action. SI Event Confirmed bearish, Liquidity and target of Overnight Low below.

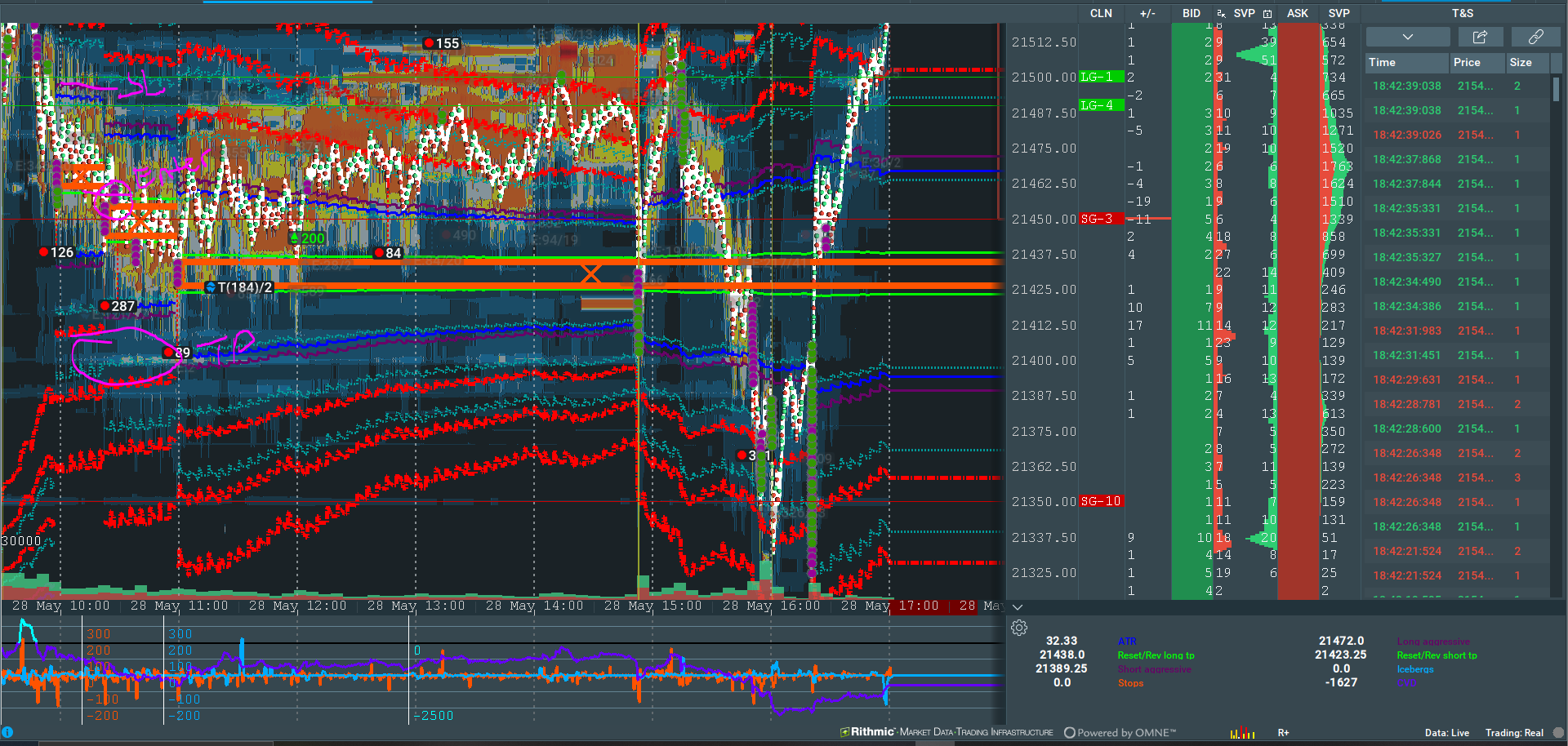

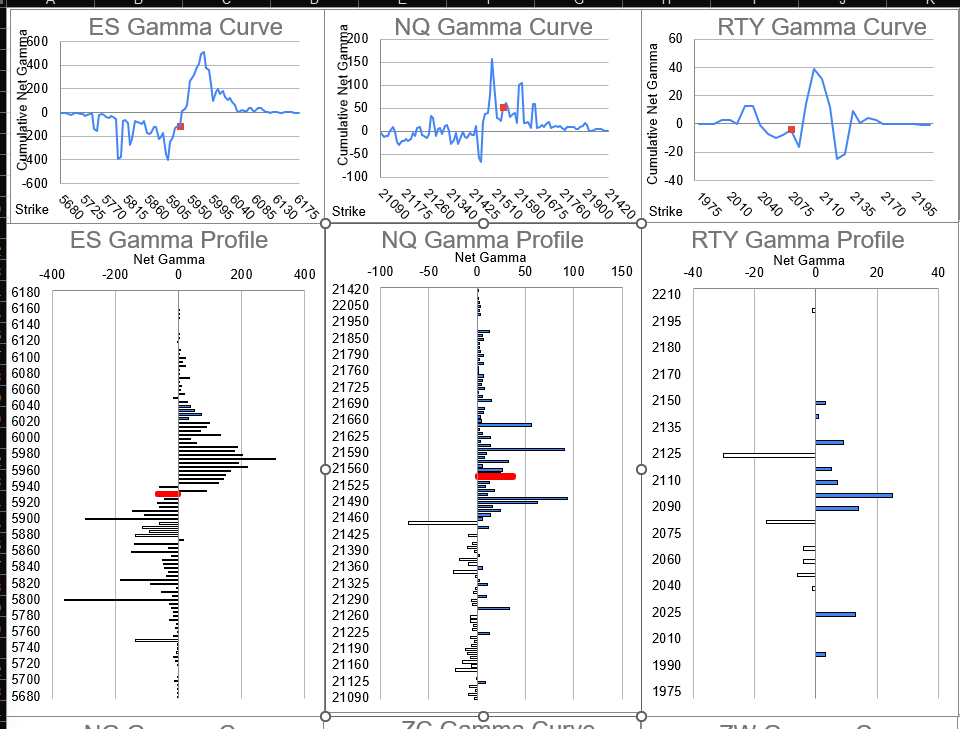

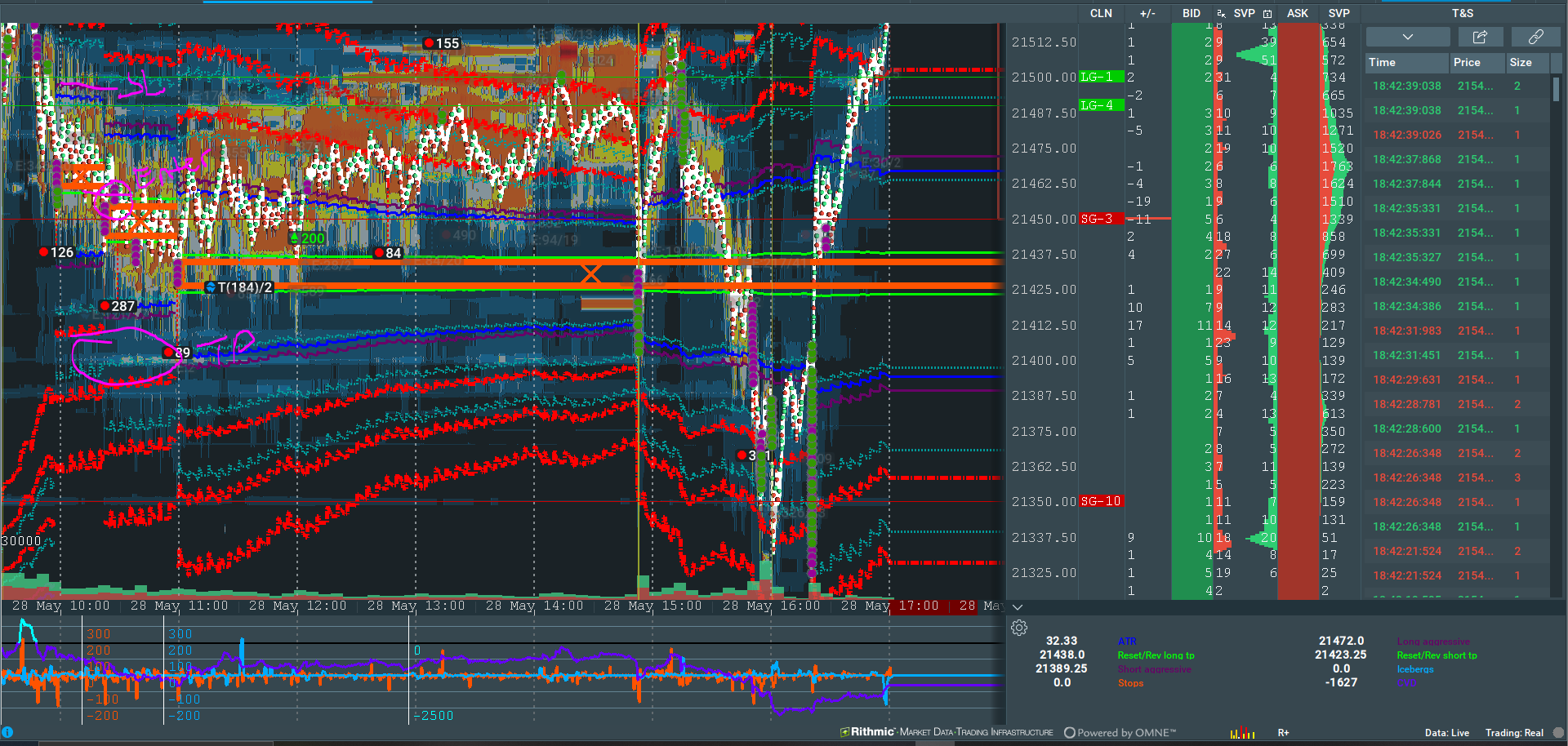

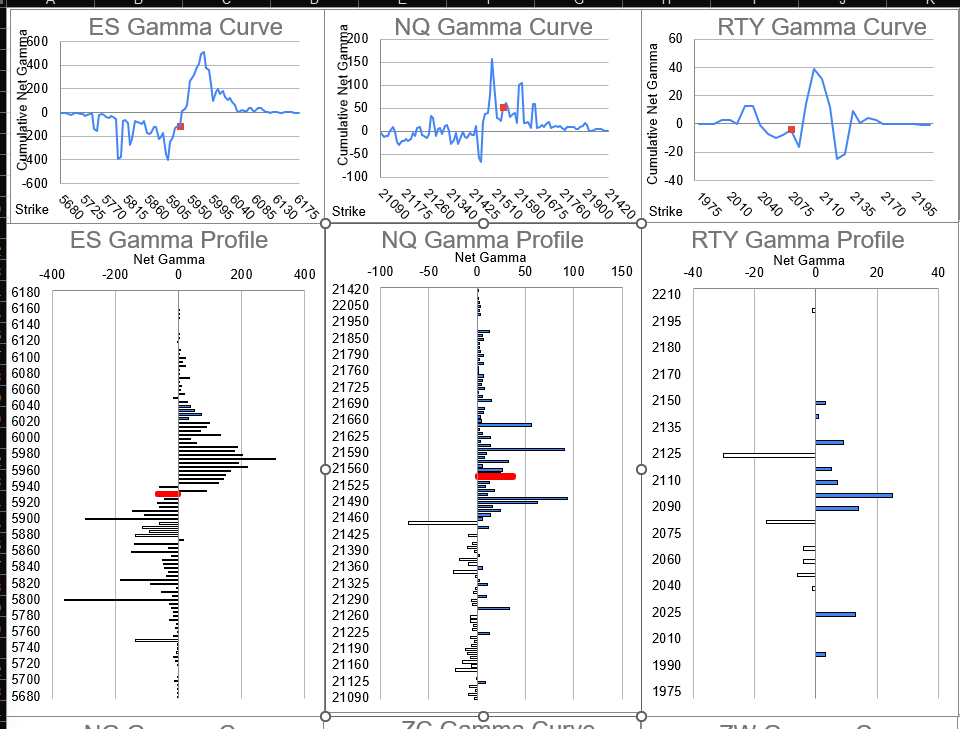

Context: Price just made a big rejection wick to the downside. It had probed above a large composite as well as the previous days high making an SFP (Swing failure pattern). was rejected hard and accepted back in balance. Was looking for it to hit the overnight low, the composite poc as well as a liquidity band all in the same area. we were just entering a large short gamma area, so i really really thought this was going to rip quick. it didnt and chopped around until the afternoon to do it. in this case the largest short gamma level acted as resistance for abit which was kind of a surprise.

Entry: Right below SI event as per rules

Exit: Price made new stop events and i trailed it to the next one.

Mistakes: There was a 3rd stop run that I could have trailed my stop too. would have been break even exit. I still believed in the trade at the time as es, rty and ym were all still dropping. just NQ was lagging the down trend. There were many opportunities to get out at break even after the 3rd stop event.

Emotions Before: Was actually flustered today due to some personal stuff, wasnt watching markets at all. but then i happened to get the alert for this trade and it matched my criteria.

Emotions During: At first had anxiety but then it didnt move, so i stopped caring, and just walked away and let it play out after i trailed the stop

Emotions After: Not too bothered, still think it was a decent setup even if my emotions weren't conducive to great trading.

Did Well: Hung in there and tried to let the trade play out. even gave it more room than I should have to work. My actual read on context was spot on. price did exactly what I believed it would, only a bit more volatile than i thought it would do it in.

Needs Improvement: Ideally on these back in composite value you want to get in close to the edge of the composite. I was abit away. ultimately price retested the edge of it and ripped to the other side.

Would I Take Again: Yes, was a good setup, and it did work out, tho my exact setup would have just been stopped out before it hit target if i didnt trail my stop.

Tags: i tagged both slow and methodical and suck you in for price action as it started as a nice slow and methodical grind down but turned into suck you in chop that didnt move for a long time.

#outbalance #normal #strongtrend #slowmethodical #suckyouin #avgvol #avgretest #shortgamma #gexheld #goodentry #algoguy #context #sfp #priceheld #hitstop #hittrailsl #newzone #slightlyupset #ineedtotradenow #imagitated #mistake #failtrail

Click on the microphone icon and begin speaking.

Speak now.

No speech was detected. You may need to adjust your microphone settings.

Click the "Allow" button above to enable your microphone.

Permission to use microphone was denied.

Permission to use microphone is blocked. To change, go to chrome://settings/contentExceptions#media-stream

Web Speech API is not supported by this browser. Upgrade to Chrome version 25 or later.

| Fill Time | Type | Qty | Price |

|---|

SL: $405 RR: 1.25

Reason: Algo Guy Bearish, Solid down trend in price action. SI Event Confirmed bearish, Liquidity and target of Overnight Low below.

Context: Price just made a big rejection wick to the downside. It had probed above a large composite as well as the previous days high making an SFP (Swing failure pattern). was rejected hard and accepted back in balance. Was looking for it to hit the overnight low, the composite poc as well as a liquidity band all in the same area. we were just entering a large short gamma area, so i really really thought this was going to rip quick. it didnt and chopped around until the afternoon to do it. in this case the largest short gamma level acted as resistance for abit which was kind of a surprise.

Entry: Right below SI event as per rules

Exit: Price made new stop events and i trailed it to the next one.

Mistakes: There was a 3rd stop run that I could have trailed my stop too. would have been break even exit. I still believed in the trade at the time as es, rty and ym were all still dropping. just NQ was lagging the down trend. There were many opportunities to get out at break even after the 3rd stop event.

Emotions Before: Was actually flustered today due to some personal stuff, wasnt watching markets at all. but then i happened to get the alert for this trade and it matched my criteria.

Emotions During: At first had anxiety but then it didnt move, so i stopped caring, and just walked away and let it play out after i trailed the stop

Emotions After: Not too bothered, still think it was a decent setup even if my emotions weren't conducive to great trading.

Did Well: Hung in there and tried to let the trade play out. even gave it more room than I should have to work. My actual read on context was spot on. price did exactly what I believed it would, only a bit more volatile than i thought it would do it in.

Needs Improvement: Ideally on these back in composite value you want to get in close to the edge of the composite. I was abit away. ultimately price retested the edge of it and ripped to the other side.

Would I Take Again: Yes, was a good setup, and it did work out, tho my exact setup would have just been stopped out before it hit target if i didnt trail my stop.

Tags: i tagged both slow and methodical and suck you in for price action as it started as a nice slow and methodical grind down but turned into suck you in chop that didnt move for a long time.

#outbalance #normal #strongtrend #slowmethodical #suckyouin #avgvol #avgretest #shortgamma #gexheld #goodentry #algoguy #context #sfp #priceheld #hitstop #hittrailsl #newzone #slightlyupset #ineedtotradenow #imagitated #mistake #failtrail